Running a truck on e-diesel costs 47% more than running a BEV truck, a study by T&E says

"This is because the lower energy and maintenance costs of a battery-electric truck quickly offset its higher purchasing costs. Meanwhile, vehicles running on e-fuels would be significantly more expensive due to the high cost of a liter of e-fuel", points out T&E.

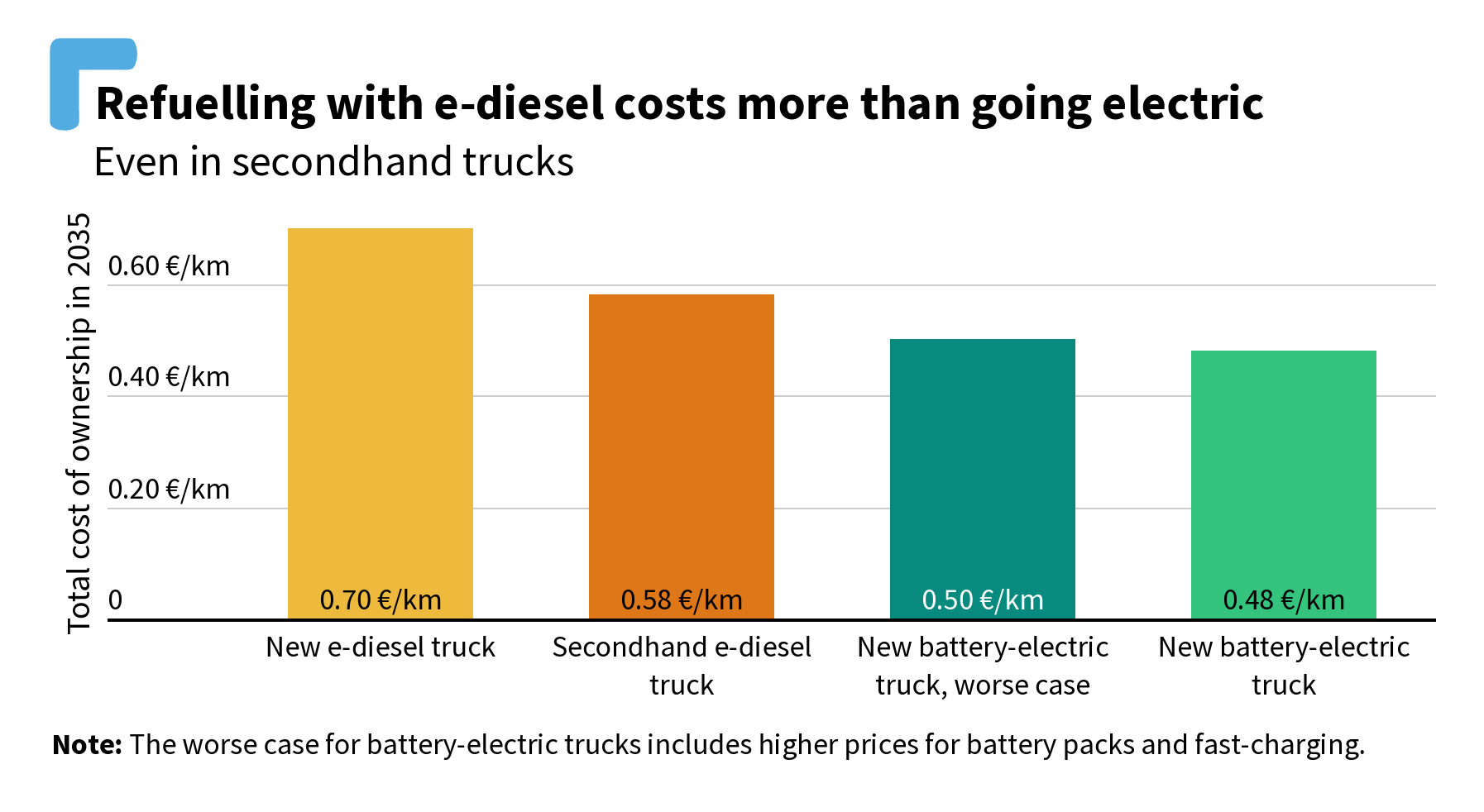

According to a study conducted by Transport & Environment (T&E), by 2035, running a truck on e-diesel costs 47% more than running a BEV (full electric) truck. “This is because the lower energy and maintenance costs of a battery-electric truck quickly offset its higher purchasing costs. Meanwhile, vehicles running on e-fuels would be significantly more expensive due to the high cost of a liter of e-fuel”, points out T&E.

Why trucks running on e-diesel are not so convenient?

The study (here’s another one by T&E about diesel vs electric trucks) compares the price of e-fuels in various scenarios, and even in the most optimistic scenario, e-fuels are still 15% more expensive than battery-electric trucks. This scenario envisages using e-fuels in a second-hand truck, and comparing a battery-electric truck with high battery and recharging costs.

Cost is a huge consideration for road freight companies, which is why battery-electric trucks are the way forward. E-fuels are a desperate attempt by the fuels industry to throw themselves a lifeline at the expense of hauliers operating on thin margins. Why force expensive e-fuels upon them when there is a cleaner and cheaper solution at their fingertips? Europe recently announced it will not use e-fuels in cars for good reason, so let’s put trucks on the same path

Max Mollière, e-mobility data analyst at T&E

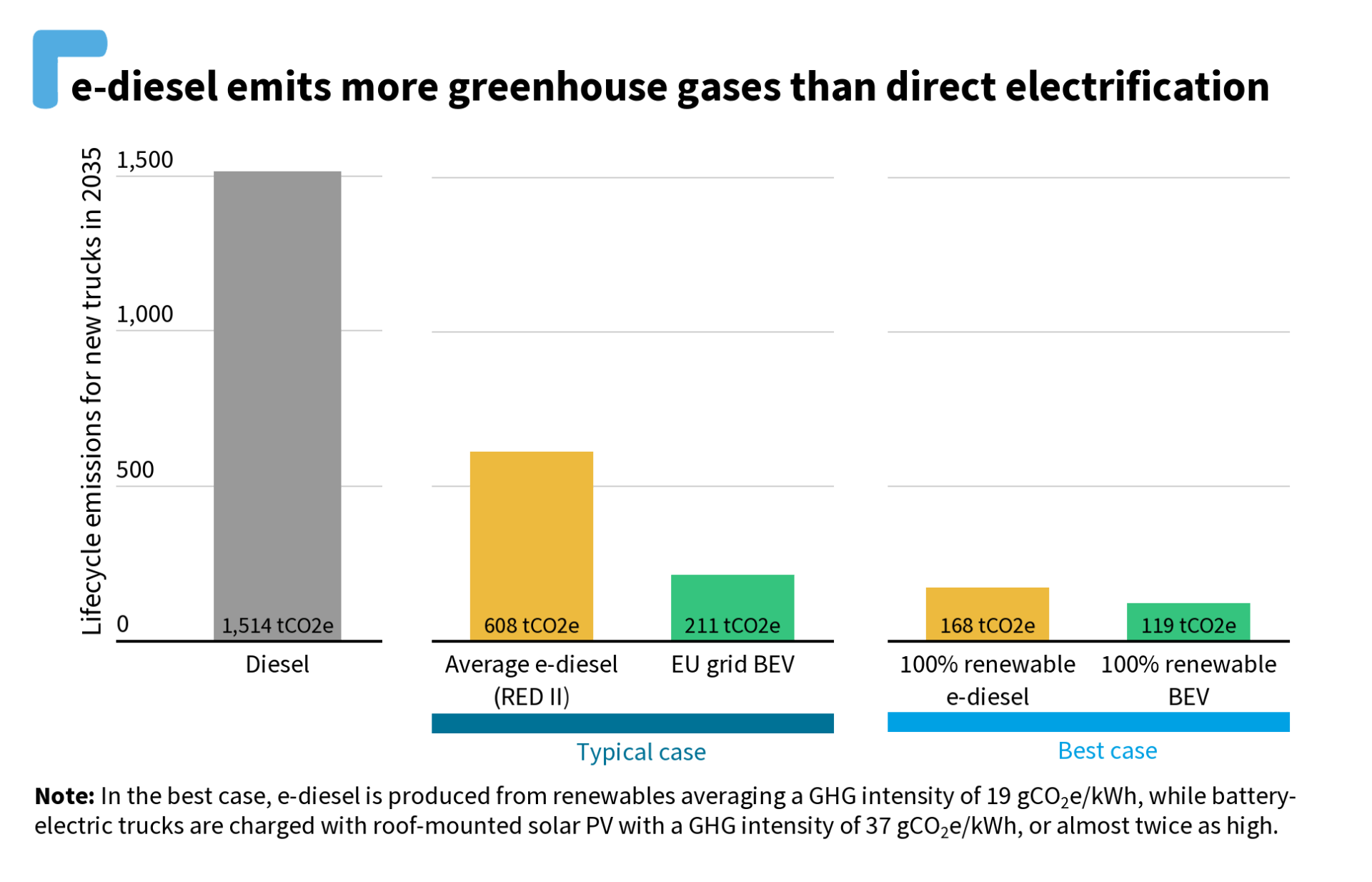

In a typical case, as showed below, a truck powered by e-diesel would emit close to three times more GHG emissions over its lifetime than a BET charged with average grid electricity. In a best-case scenario where 100% renewable energy is used for e-fuel production and BET charging, an e-diesel truck still emits 41% more than a BET. In spite of the higher manufacturing emissions due to battery production, e-fuel trucks emit much higher GHG emissions over their lifetime than BETs. This is because most of the GHG emissions are caused during the driving phase, and trucks have high mileage.

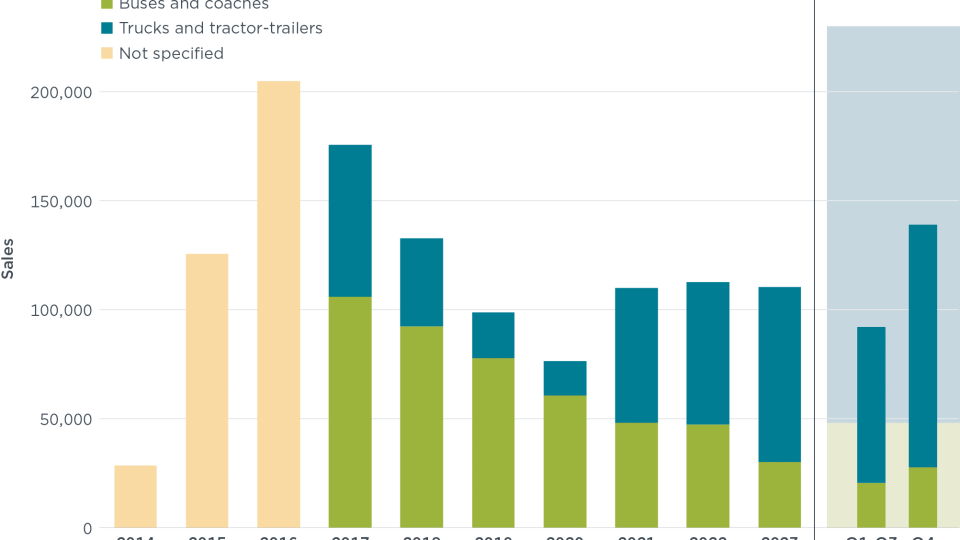

E-fuels production forecasts

Concawe, the oil industry’s research group, modelled that European production of e-fuels for road transport would reach 6 Mtoe in 2035. This would meet only 6% of trucks’ fuel demand in 2035. Current projections for imports of transport e-fuels only foresee imports of e-kerosene and e-ammonia, which would not apply for road transport. There are no public projections for import volumes of e-diesel or e-petrol from abroad into Europe, meaning the supply of e-fuels for trucks and cars would be very limited. “After its attempt with cars, the fossil fuel industry is hoping to resurrect e-fuels in trucks”, commented Max Mollière.