T&E and the electric revolution: why European truck makers may lose up to 11% of their market share by 2035

Boston Consulting Group (BCG), the authors of the study, find EU demand for zero-emission trucks will surge to 55% of sales by 2030, as prices fall. But current truck CO2 standards risk European manufacturers not meeting demand. “Our truck industry risks repeating the loss of sales to Tesla and BYD that we’ve started seeing in the car market", said Sofie Defour, freight director at T&E.

Photo credit: Chris Steule

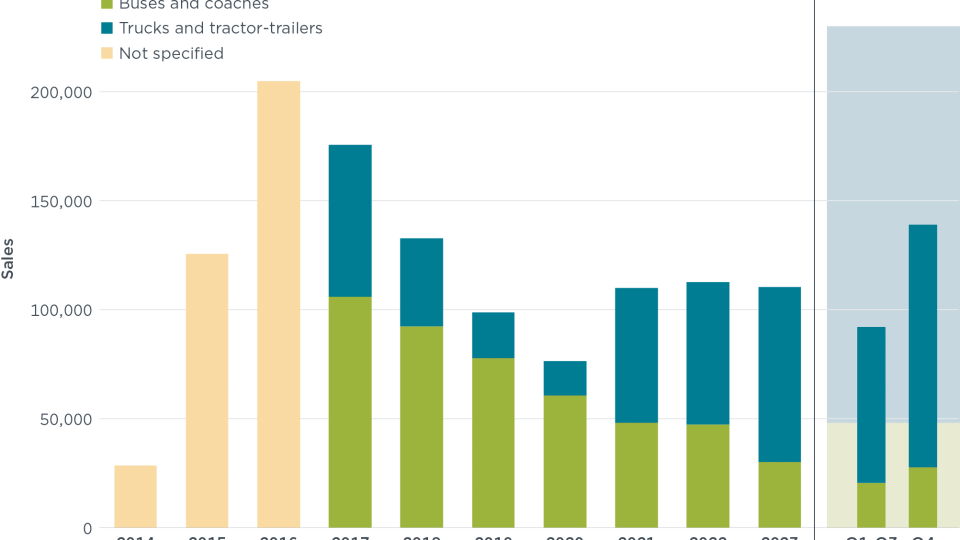

According to a study presented by T&E (Transport & Environment), European truck makers may lose up to 11% of their market share by 2035, due to the competitors from outside Europe, among which Tesla and BYD stand up. The above mentioned study was commissioned by T&E and conducted by Boston Consulting Group (BCG).

BCG finds EU demand for zero-emission trucks will surge to 55% of sales by 2030, as prices fall. But current truck CO2 standards risk European manufacturers not meeting demand. T&E said EU lawmakers should set more ambitious targets to require truckmakers to produce more zero-emission vehicles. This would help avoid a repeat of the car market, where European car companies that were slow to electrify now face increased competition in the EU from Chinese EV manufacturers.

European truck emissions regulations should be stricter, T&E says

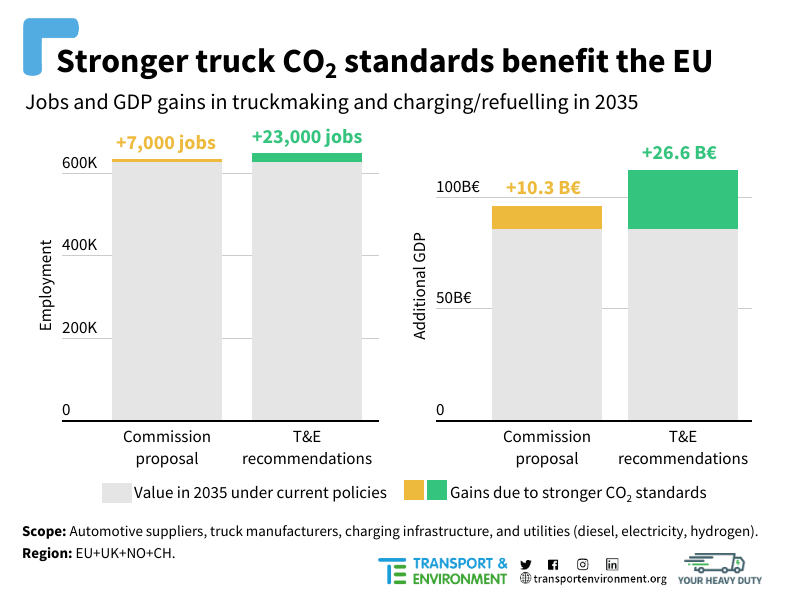

The contribution of the truck manufacturing sector to the European economy would also increase. The proposed targets by the EU Commission would create €10 billion in additional GDP compared to current standards, according to T&E analysis based on BCG’s modelling. T&E’s proposed targets would add €27 billion in GDP.

Also, stronger CO2 targets would ensure European workers reap the full benefits of the switch to electric trucks. BCG modelled the impact on employment of different speeds of transition to zero-emission trucks, and found that the faster the transition, the bigger the gains by 2035. The targets proposed by the European Commission would create 7,000 additional jobs in the sector by 2035 compared to current targets, finds T&E analysis based on BCG’s modelling. Under the more ambitious targets proposed by T&E, 23,000 new jobs would be created.

“Do not repeat the mistakes experienced in the car industry”

“Our truck industry risks repeating the loss of sales to Tesla and BYD that we’ve started seeing in the car market. If Volkswagen and Stellantis could go back five years, to when electric cars had the same market share as electric trucks do now, would they make the same choices? To retain dominance at home, European truckmakers need to go electric faster. More ambitious EU CO2 standards, alongside green industrial policy, will ensure they keep up with demand while bringing down costs for hauliers”, said Sofie Defour, freight director at T&E. “The transition to zero-emission trucks is good for jobs and the climate. But the size of the economic gains depends on the speed of the transition. EU lawmakers need to chart a more ambitious course for truckmakers than what’s currently on the table.”