China leads (so far) the race to electric trucks. Global trends and forecasts from Interact Analysis

China is the country in which most electric trucks were sold last year. In the future, the advantage gained by the Far Eastern country may decrease, according to a study recently published by Interact Analysis, which figured out a couple of possible scenarios.

China is the country in which most electric trucks were sold last year. In the future, the advantage gained by the Far Eastern country may decrease, according to a study recently published by Interact Analysis, a primary research company in the industrial field. Let’s start from the figures. In 2021, China registered nearly 80,000 battery electric trucks, ahead of Europe where just over 60,000 were registered and well ahead of North America where only 4,012 were registered.

Figures: China currently stands out for electric trucks

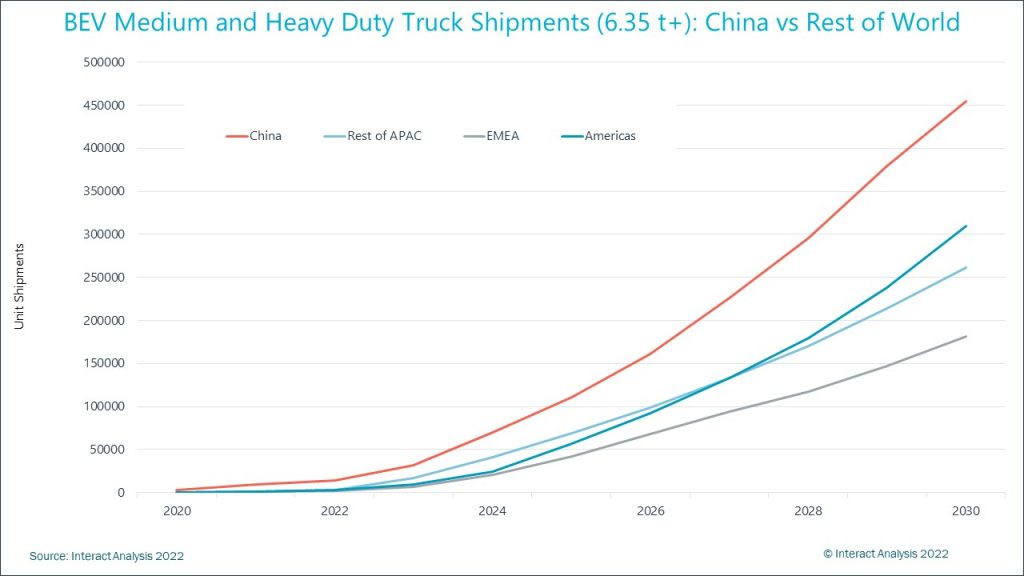

The projections for the end of 2022 deal with over 200,000 e-trucks for China, 139,000 for Europe and 91,000 for North America (of which 87,000 are forecast to be in the US). Looking at medium and heavy-duty trucks, China is forecast to remain ahead to 2030. This is because China has a larger total market for these trucks, so it can beat Europe and US on electric truck volumes by having a similar penetration, according to Interact Analysis. While this particular insight focuses on battery electric vehicles, China also has a strong position on fuel cell vehicles, selling the majority of fuel cell trucks (and buses) registered in the world in 2021 and 2022.

“China’s leadership position does not mean that the US, Europe and Japan should give up”, we read. “The West (and Japan) may have started slowly, with poor levels of investment and focus and awareness on electric vehicles from both private companies and governments for most of the 2010-2019 decade. However, things have started to change in recent years. So far, much of the West’s improved focus on electric trucks in 2020-2022 relates more to plans, vehicle announcements, prototypes and so on, rather than large scale mass production or regular announcements relating to hundreds or thousands of vehicles per deal. However, this will change in 2023 and 2024 as the efforts of the last few years start to bear fruit and battery manufacturing capacity outside China starts to catch up“.

“The current price of diesel (and petrol) is high and our assumption is that it will stay at a similar level in the next few years. We also expect steady, slow improvements to electric vehicle TCO in the coming years due to the – eventual – falling price of batteries and better economies of scale of EV production. The TCO for electric commercial vehicles in 2022-2025 therefore looks attractive enough to see strong growth, however the production capacity needs to catch up”.

Potrebbe interessarti

Which country has the highest number of charging stations? Spoiler: it’s China!

The possible scenarios for the next years

“If Western companies invest and pivot away from ICE vehicles rapidly, and Western governments start to give greater subsidies and attention to electric trucks, then by 2030 Europe and US could catch up and be on a level playing field with China. Alternatively, if the West is slow to react and government support is almost non-existent, China could entrench itself and achieve a dominant position by 2030. We project that the reality will likely fall between the two extremes. This means that we expect that China will continue to be the volume leader throughout the decade, but with the US and Europe steadily reducing the advantage. In each of China, North America and Europe, sales will continue to be led by companies headquartered in their home region, while China will probably continue to lead elsewhere, such as South America”.