Battery packs, EV chargers and portfolio resilience. Our interview with BorgWarner’s top management

BorgWarner is shifting its business to embrace zero-emission vehicles, thus adapting and improving its R&D structure, as well as production processes. At IAA 2024, we’ve had the opportunity to talk to Harry Husted, Vice President and CTO of BorgWarner, and Paul Farrell, Executive Vice President and Chief Strategy Officer, about the current and next steps of the company in the CV business.

Both battery packs and EV charging systems are key products for the renovated offering BorgWarner is boosting in the new energy commercial vehicle market. That means the global group is shifting its business to embrace zero-emission vehicles, thus adapting and improving its R&D structure, as well as production processes. At IAA 2024, we’ve had the opportunity to talk to Harry Husted, Vice President and CTO of BorgWarner, and Paul Farrell, Executive Vice President and Chief Strategy Officer, about the current and next steps of the company in the current challenging technological environment. Starting with the latest product launches.

Going deeper into BorgWarner’s EV product portfolio

Let’s start with the batteries: what are the main technical features of the LFP battery pack BorgWarner launched at IAA?

We’ve updated our offering in terms of LFP batteries. The new packs bring numerous advantages compared to our current packs. We’re adding cycle life. We also have increased charging rate, meaning we’re able to charge batteries faster, which will help people. And then the cost profile is better. The LFP technology allows us to lower costs and maintain the energy density, which is great.

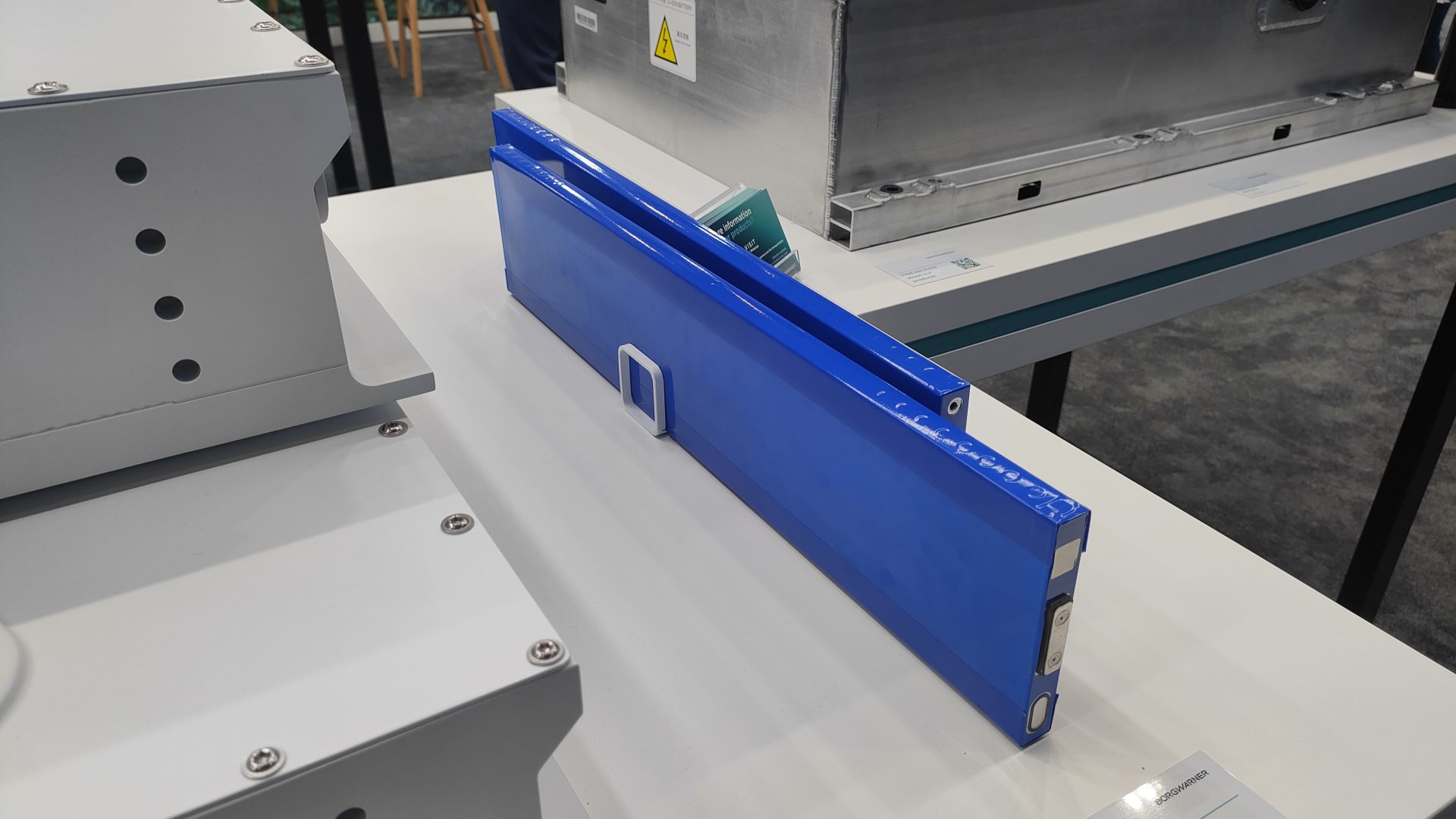

Also, we have this modular design approach, resulting in quite a flat battery pack. The first pack we introduce is very low height, designed to be installed under the floor of buses, which is helpful. The cubic pack is conceived for medium- and heavy-duty trucks. Packaging flexibility is a huge advantage for us. In terms of technology, we’re using the blade cells from Findreams (a Chinese company belonging to the BYD group, ed), as announced earlier this year. Blade cells have a special shape, quite long and thin at the same time, ensuring great volumetric efficiency.

So, why is BorgWarner relying on LFP technology?

China has built a lot of capacity in LFP. It means the supply capacity has grown a lot, and the cost structure has really improved. Basically, LFP packs have lower costs, and that’s a real advantage. The LFP packs are currently under development, and we expect volumes will grow in the near future.

What’s your view in terms of applications for the LFP battery packs BorgWarner’s going to produce?

We’re more focused on medium- to heavy duty, and that’s the range of our current agreement with Findreams. Bus is a big application, as well. Today, buses are the main application for us, but we really want to expand in the truck sector, as well as off-road applications. Our modular design gives us the ability to do many things with our battery packs.

The battery pack design

How’s the battery pack design managed within the factory?

When you see the design, it’s really like a Lego block. Blade cells are standard and base, modules have the same size. Modules will be assembled in a single line, then we’ll have different options for the flat or the cube pack. The factory will be very efficient in our view.

How’s the agreement with Findreams arranged?

We’ve got a licensing agreement with Findreams to purchase their cells. Then, we’re designing our own battery packs according to the cell specifications. The license is for Europe and the U.S., so outside China. We both want to grow in this market. We want to sell more battery packs; they want to sell more cells. It’s a good and complementary partnership.

Switching to charging systems, what has BorgWarner introduced at IAA? What are the major technical points?

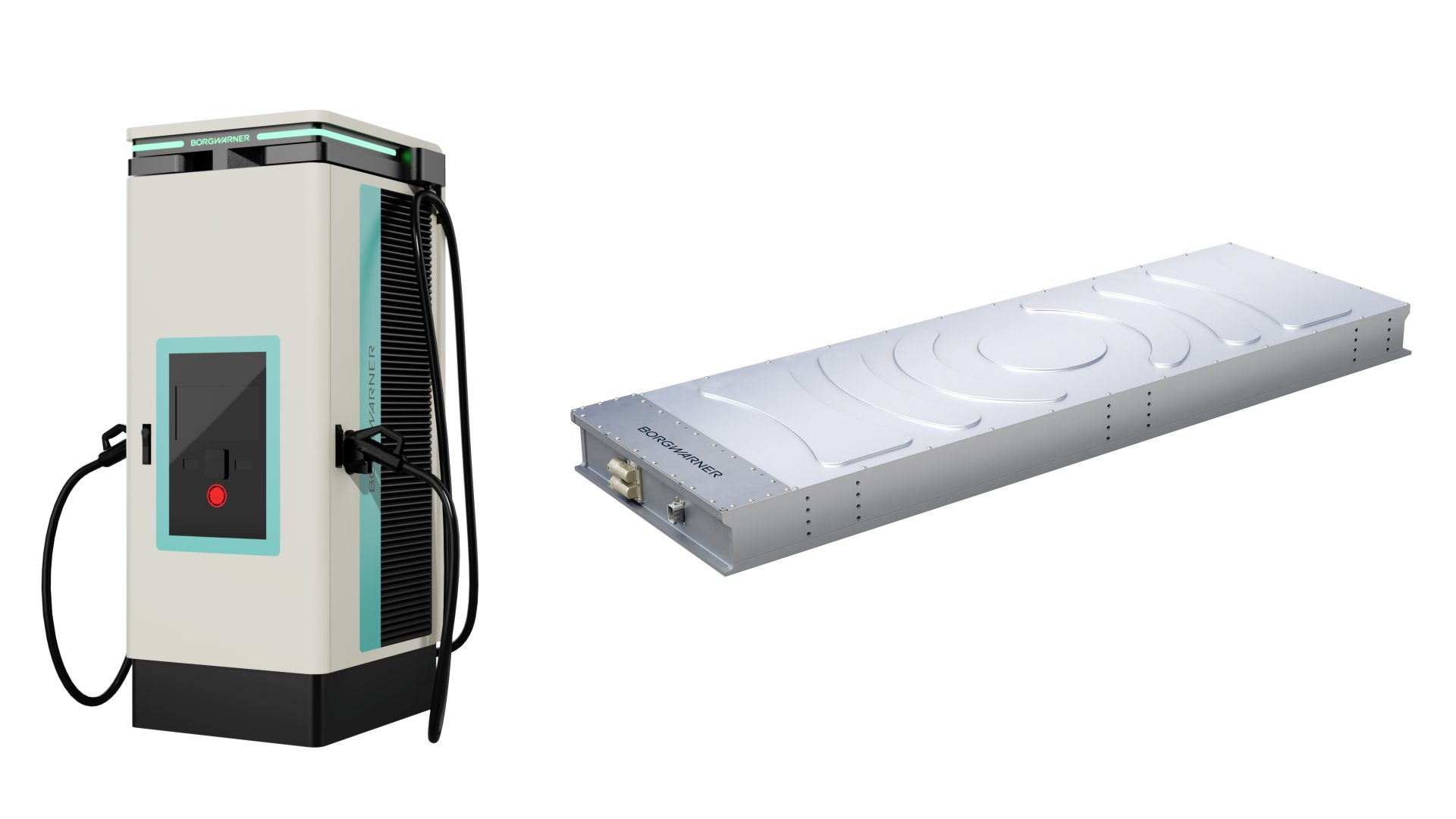

We’ve launched our new 360kW integrated charger, a new proposal to the market. What’s great about it is that we have a very high-power offering, as well as a complete set of features we feel customers need. It’s got cable management, and a color display screen. We can supply depots, and en-route charging for highway charging. We can have a variable number of power supplies inside, from 120kW to 360kW. The price scales depending on how much power you need.

Megawatt chargers? Not yet, but tests are ongoing

Does BorgWarner have plans about megawatt charging systems?

We think megawatt charging requires a little more time. We’re doing some megawatt charging tests with our team in China. We want to grow with the current products first, then invest in megawatt charging. For now, we want to sell chargers for passenger vehicles on the highways and we want to sell chargers for commercial vehicles, getting volume scales, at first.

What’s the advantage of BorgWarner in the crowded charging system market?

There’s a lot of different offerings out there. As BorgWarner, we’re able to have a complete offer thanks to the fact we’re a global company. Also, as we make battery packs, technical understanding of the products is very deep. The core electronics and power electronics capabilities are very high.

How’s the transition from conventional powertrain to electrification going within BorgWarner? Also, in terms of R&D resources and product development?

We talk a lot about portfolio resilience. In our portfolio, we have products to support ICE vehicles, hybrid vehicles, as well as electrified vehicles. A big focus of the last few years was to build out a strong base.

Acquisitions were paramount to deepen our product portfolio in this sense. Indeed, we paid close attention to integrating the companies we have been acquiring, making them really part of BorgWarner. Another key step was reskilling our engineers from our traditional products and applications to electric products. We’ve had a collaboration with Aachen university, in Germany, and we put in total almost 400 engineers globally through that program, which is a 3-month custom program. The target is to help mechanical engineers acquire skills in electronics and mechatronics. For the U.S. training, we’ve used the University of Wisconsin. Also, we have a very similar program with universities in China.

Is a group like BorgWarner considering further investments in the hydrogen sector?

We’re already in that space, as we can adapt some of our products for the fuel cell scenario, as well as for the hydrogen-powered ICE scenario. We don’t make the fuel cell stack, but we have products suitable for those kinds of powertrains. In terms of the opportunities, we see hydrogen as an important part to decarbonize the global economy. It’s still evolving and we’re ready to adapt.

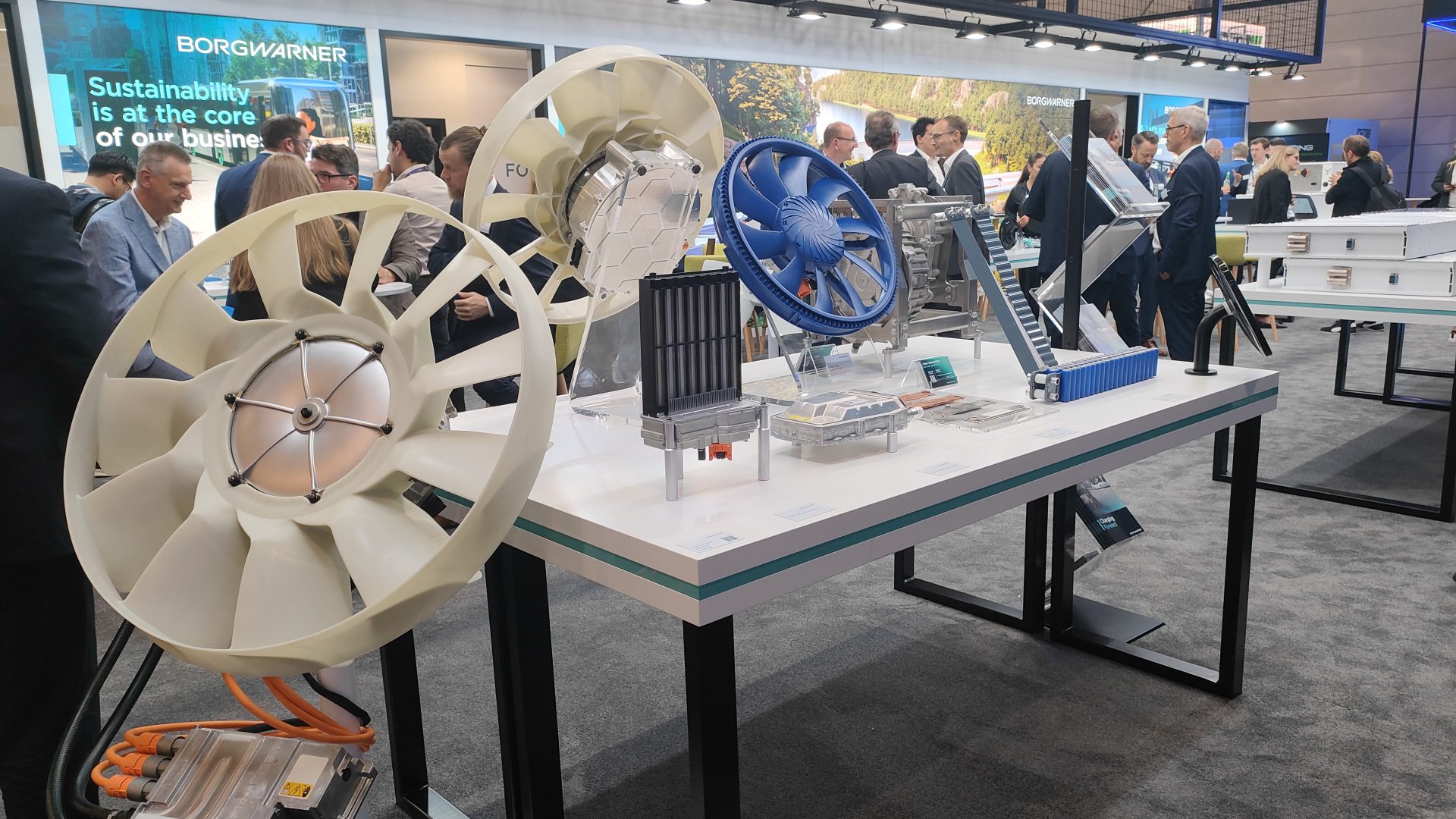

For instance, we have in our portfolio a 40kW fan that was requested specifically by a manufacturer to help with fuel cell vehicles, which need to move a lot of air to cool systems. Talking about hydrogen ICEs, every engine still needs a good turbocharger, by the way!