There’s room for BEVs and alternative fuels in the global truck market in the next decade. An analysis by KGP

The drivers for zero emission vehicle (ZEV) are starting to converge, even in heavy-duty truck segments, with OEMs providing various model options, governments implementing supportive policies and now infrastructure investment starting to gain traction. In the EU, KGP estimates around 30% of urban medium-duty truck will be battery electric by 2030.

In the recently published Global Commercial Vehicle Powertrain Forecast (GCVPTF), the automotive consulting group KGP analyzed the global truck market, providing some interesting forecasts on future trends, especially regarding electrification and alternative fuels. The following post is written by KGP for the readers of Sustainable Truck&Van.

KGP: the global truck market after the pandemic outbursts

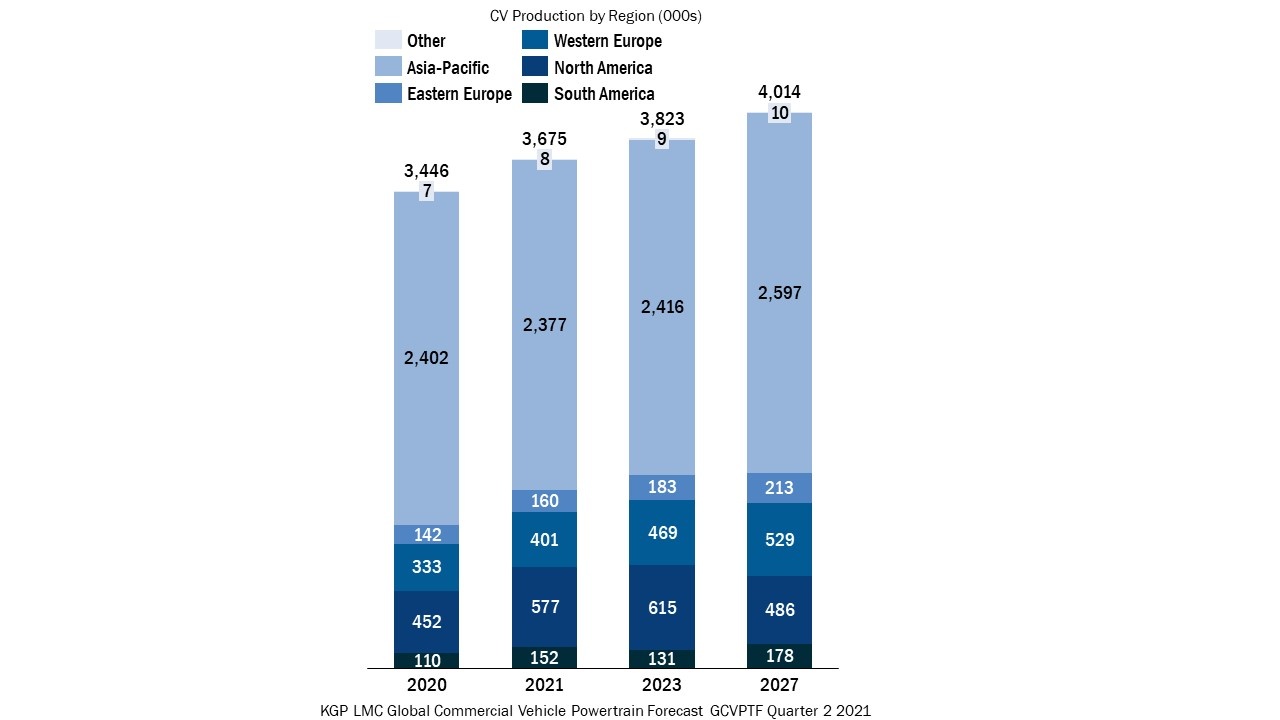

The global truck market was severely distorted last year as the pandemic hit all regions hard, bar China which produced record truck volumes. Usually, China produces 40% of the global truck volume on average but accounted for just under 60% in 2020, as stimulus and scrappage saw over 1.5m heavy-duty trucks sold in the market.

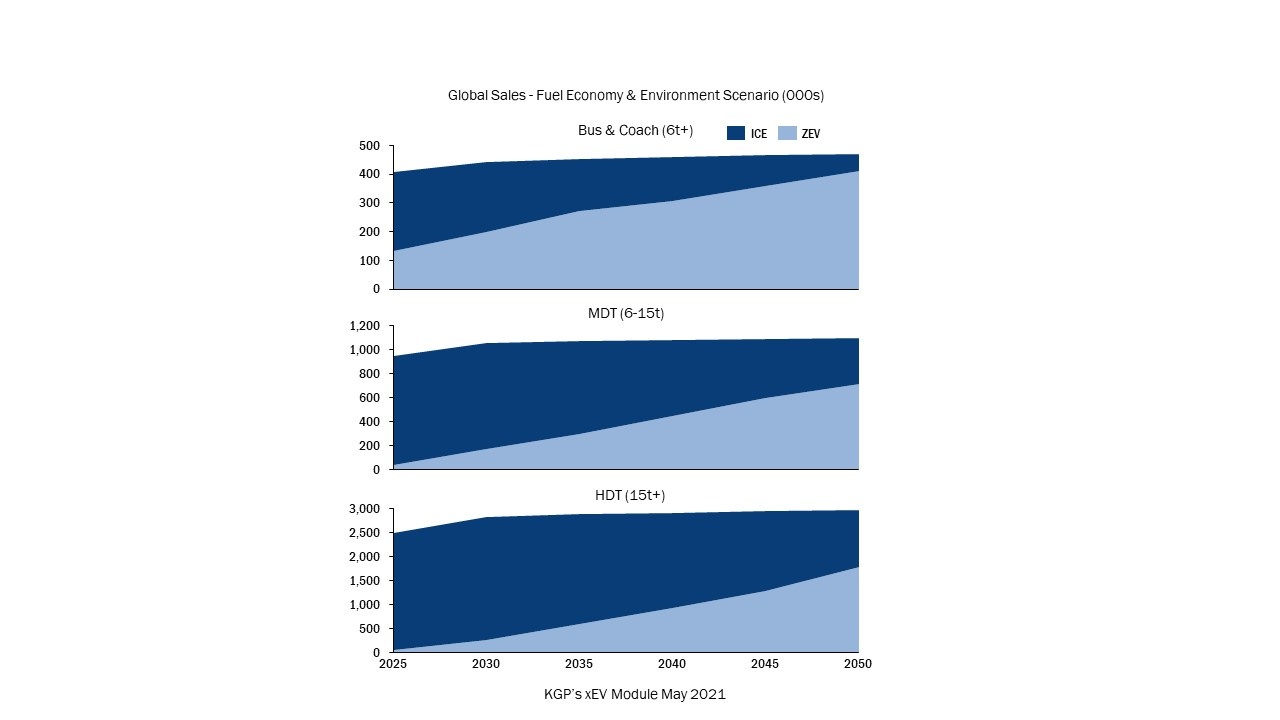

Volumes are taken from KGP’s Global Commercial Vehicle Powertrain Forecast (GCVPTF) published quarterly in partnership with LMC Automotive which assesses Truck and Bus production over 6T by OEM, fuel, emissions compliance and electrification type.

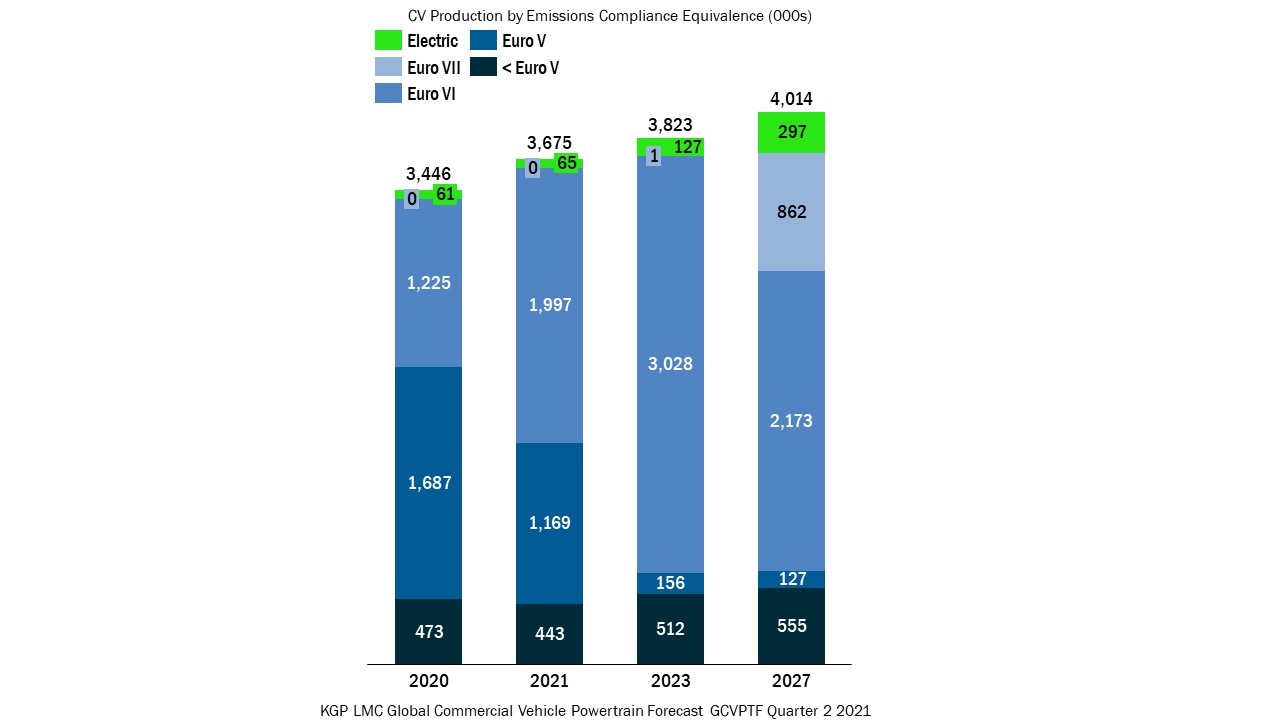

Over 80% of global truck production will be at least Euro VI by 2025

As electrification and alternative fuels share accelerates towards 2030 however, further tightening of emissions will continue including what may be a final round of noxious emissions legislation in developed markets. This will begin in California from 2024, before going nationwide in the US in 2027. Europe is likely to closely follow this timing, with Euro VII, with China not too far behind. By 2025 over 80% of global truck production will be Euro VI equivalent and above.

The drivers for zero emission vehicle (ZEV) are starting to converge, even in heavy-duty truck segments, with OEMs providing various model options, governments implementing supportive policies and now infrastructure investment starting to gain traction.

Electrification: starting (almost) from scratch

The global ZEV truck market is in its infancy when compared to the bus market. In 2020 less than 1% of sales were equipped with either a battery electric or a fuel cell powertrain.

The powertrains chosen by region and even intra-regions will remain diverse in the short and medium term although modularity will increase for electrified modes to save costs both for R&D and vehicle prices.

The medium-duty truck (6-15 tonnes), especially in urban applications, is expected to generate strong adoption of battery powertrains. We have already seen Daimler announcing its exit of the medium-duty engine market to focus on ZEV. In the EU, KGP estimates around 30% of urban medium-duty truck will be battery electric by 2030.

Long haul applications: an opportunity for alternative fuels

For long haul applications, both battery electric and hydrogen fuel cells have concerns over range, cost and reliability and any hydrogen ICE growth is still uncertain. There does remain an opportunity for alternative fuels, KGP estimates renewable natural gas at 12% of the global CV market by 2030, and others including HVO are expected to grow. However, in all scenarios recent policy changes at country, region and corporate level are driving faster adoption than was expected in 2019, pre-COVID.